Today’s super low interest rates have dramatically reduced the cost of interest on housing loans, and it is now possible to buy a condominium for far less burden than during the bubble period.

Condo prices have come down in tandem with the decline in land prices due to the economic slump, making them more affordable.

The following is a brief introduction for those interested in getting into the condo buy-to-let business, and along the way we answer some typical questions such as “Why do you recommend buying a condo to let?” and “What are the benefits and drawbacks?”

Buying a condo to let is one method of asset management currently drawing attention. It involves buying a condo to rent out, rather than live in oneself, in order to be able to live comfortably on the rent income generated as a result. It offers many attractions compared with other methods of asset management, and we hope you will read on to consider it more closely.

Condominiums acquired for investment purposes offer a variety of advantages depending on how they are operated. They can provide a stable future revenue stream in the form of rent income like a private pension, and they can also provide security for the owner’s family like life insurance. Depending on the state of the economy, they can also be sold for a profit, and are popular as a means of employing assets in a way that makes them less vulnerable to losing their value.

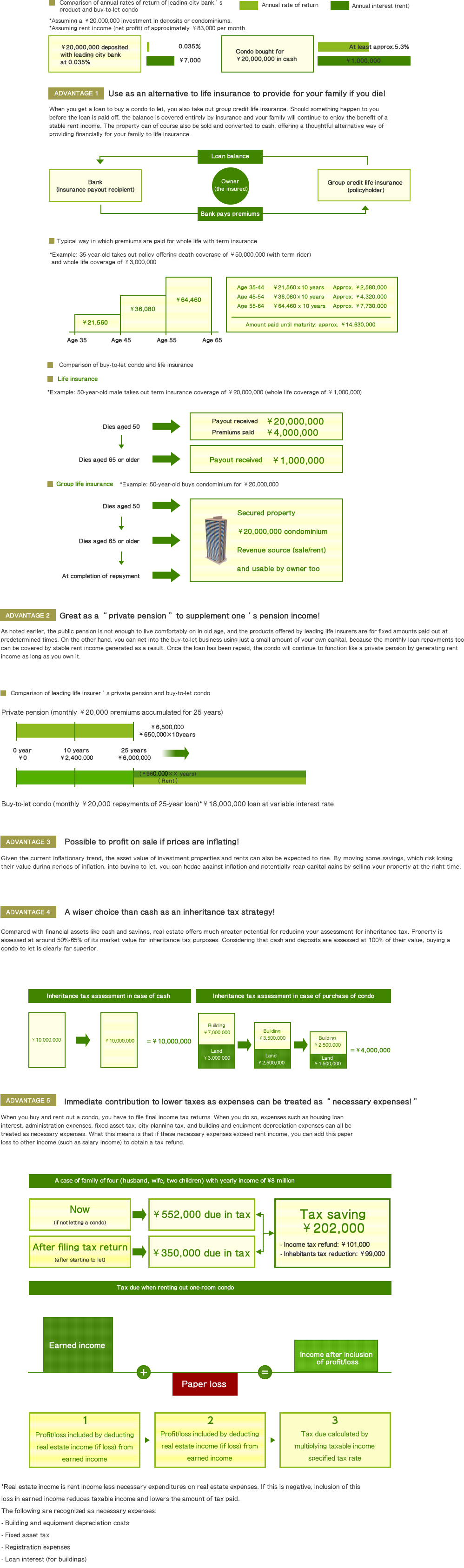

With interest rates at a historic low, the rates of return from the rent income generated by buying to let remain far higher than those of other investments, such as time deposits with city banks. They also come out on top as a safer form of asset management than other financial products that require taking high risks in exchange for high returns. This is especially so in the Greater Tokyo area, where rates of return from one-room condominiums have stayed at 4%-5% for the past few years.

The biggest risk with buying a condo to let is the risk of a vacancy occurring between tenants, as this means there is no rent income coming in. After you buy a condo to let with the Liv Group, however, we provide full support, from operation through to management, to help mitigate such risks.

Help with all the complicated aspects of renting out a property

Under this sublease system, the Liv Group enters a master lease agreement with the condo owner, and then enters a sublease agreement with a third party to ensure payment of a monthly contracted rent, irrespective of whether the property is occupied.

*The owner is guaranteed an amount less a certain proportion of the occupancy rent as contracted rent.

The Liv Group leases rental units ranging in size from one-room apartments and above, and provides a guarantee of rent. The owner is freed from the complicated aspects of renting out and enjoys a stable, guaranteed income.

Under this system, the Liv Group assumes responsibility for managing the property on behalf of the owner as landlord (lessor) and handling all business with the tenant (lessee). This includes everything from collecting rent to sending demands when the tenant is in arrears and performing inspections when the tenant moves out.

- Rent is collected and transferred by Liv to the owner’s designated bank account.

- Liv deducts a fixed percentage of the monthly rent as its administrative fee.

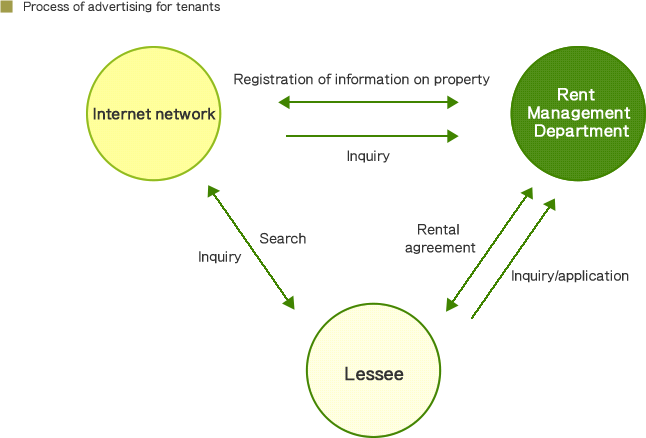

The Lease Management Department leads the process of finding new tenants, using the Internet and other resources to provide extensive information and attentive support.

The Liv Group also performs all the work normally considered the job of the landlord for owners, including being present when tenants move out, restoring properties to their original condition and performing other renovation work, and dealing with problems that arise during disasters, plumbing problems, difficulties with tenants, and so on. We even offer a security service.

We have established a Renovation Department to gather information on and acquire new techniques and materials so that we can employ them and suggest their use to owners. Keeping our finger on the pulse like this helps us to anticipate new needs and appeal to new markets in order to find tenants more efficiently and maintain high occupancy rates for our clients. We also seek to minimize the problems that can occur when tenants move out and conditions are restored by, for example, installing next-generation “CT catalysts” in all living space in apartments.

Condo management and maintenance involves a whole range of tasks, including clerical, accounting, and equipment inspection works. Utilizing our specialist expertise, we aim to deliver advanced quality control. Under management service agreements with condo owners associations, we perform maintenance, management, inspections, and other routine tasks. We also develop long-term repair plans to preserve buildings’ property value and propose their implementation to condo owner associations. We believe that sincere, reliable management is the key to maintaining owners’ valued assets.

“Safety management” is essential to life in the city. We have launched a new security service, provided by security specialist Secom, to ensure round the clock, round the year safety and security for tenants. This guarantees fast response in the event of a fire or other incident, and allows security guards and engineers to be rapidly dispatched.

Banks use different standards for assessing housing loan applications and applications for loans to purchase a condo for investment purposes, so it is often still possibly to obtain a loan for an investment when you are still paying off a home loan. However, please first consult one of our advisers as conditions regarding amounts and loan approvals vary.